Stock Analysis

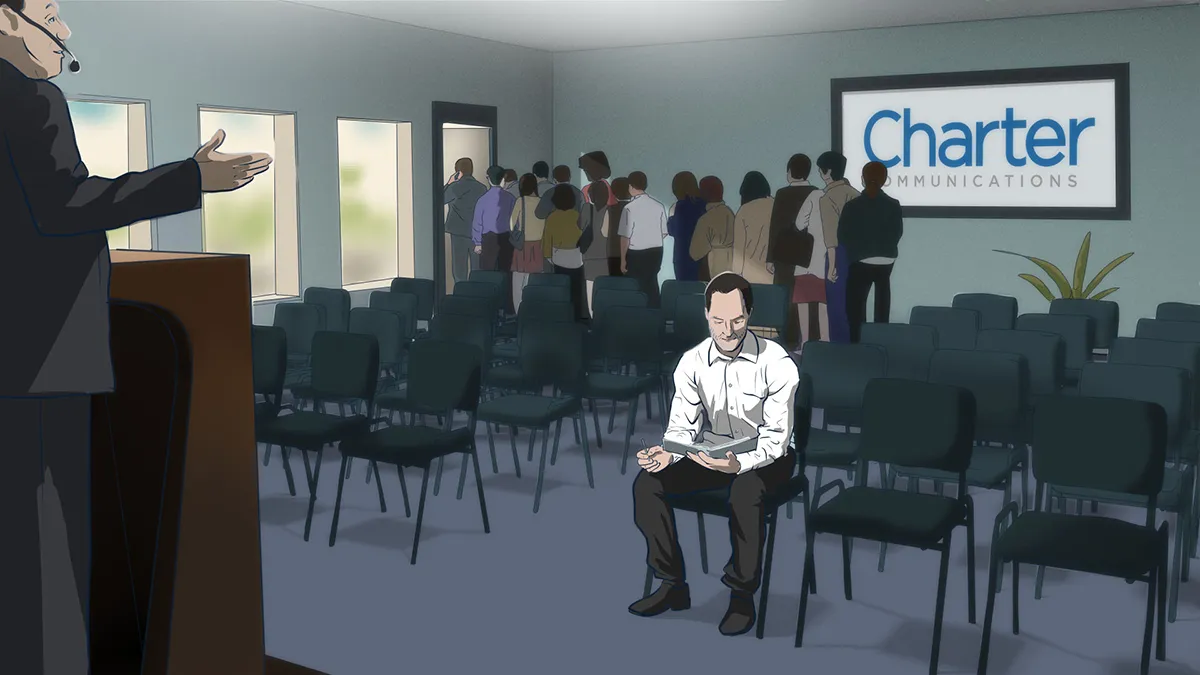

Why we’re confident in our Charter investment

The CHTR decline may have kicked us in the face, but our extensive research is telling we’re not wrong about our Charter investment. Here’s why:

Stock Market Roller Coaster: Prepare for a Decade or Two of Disappointing Returns!

Investors who own index funds have likely strapped themselves into a giant stock market roller coaster which, to this point, has only gone up.

Why we’re not celebrating the vindication of our investing principles

Value investors have had a miserable time over the past years. Now that our investing principles are finally being vindicated, you’d expect us to gloat. But Herr Schadenfreude is not a friend of ours.

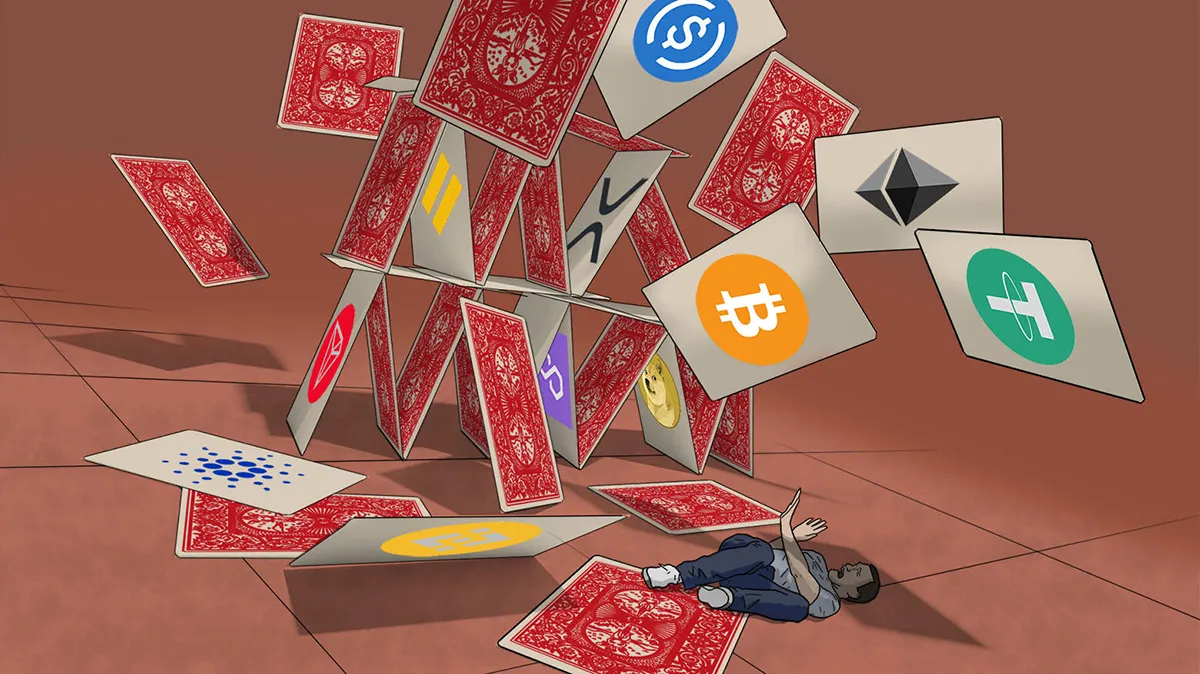

How Greed and Leverage Destroyed the Crypto Tulip Market

Crypto currency was touted as antidote to central banking. But with its own flaws, is the system itself to blame for this crypto market crash?

Why non-transitory recession is coming and how to face it as an investor

Recessions are like forest fires – small ones are healthy for the forest. However, the longer you suppress fire, the more dead material the forest accumulates. Eventually, when it does pay a visit, it is more devastating and its effects are more long-lasting.The recession that is coming could be a big fire.

Curmudgeon on Cryptocurrency

I share a story about when four separate people asked me about "investing" in cryptocurrencies, as well as my thoughts on Bitcoin and other crypto-assets.

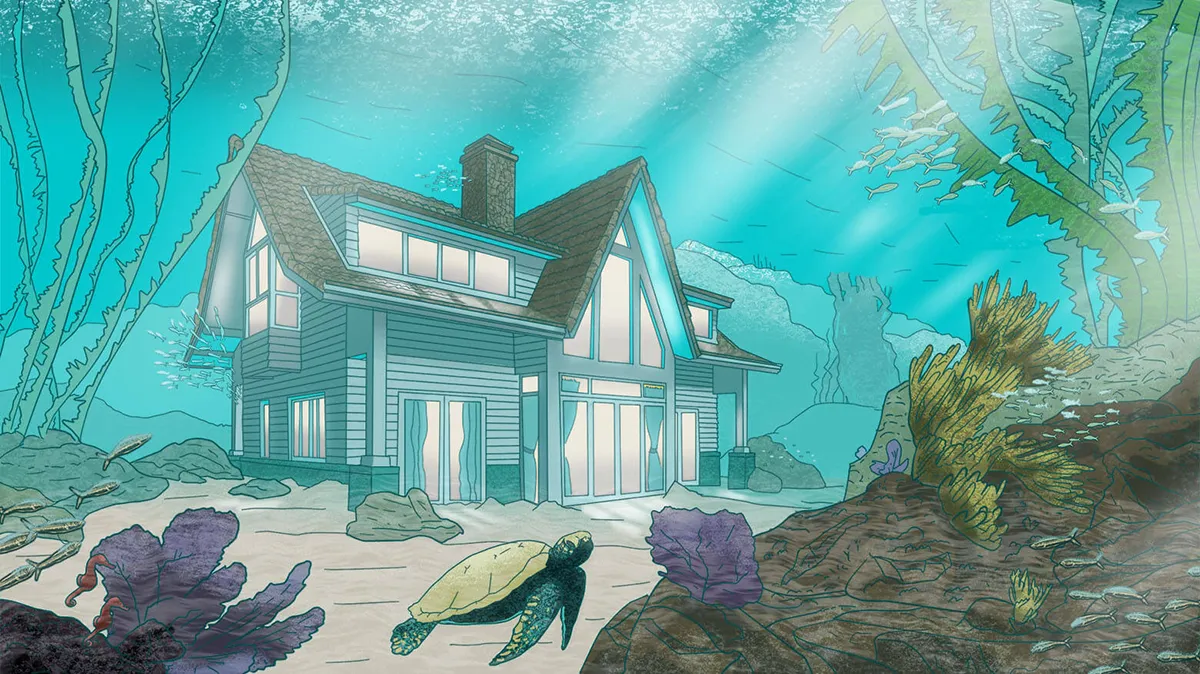

Are housing prices about to drop? A value investor’s take

Inflation is on the rise in the US. So are the interest rates. So what about the housing market? Are we going to see housing prices decline? Read below to find out.

Random Thoughts on the Russian War in Ukraine (Hint: It’s Not Going Well for Russia)

The following is a loose collection of random thoughts and observations on the Russian invasion of Ukraine. Rather than a coherent article, I offer some insights that have emerged as the war has dragged on.

IMA is not for everyone. I’m fine with that!

How great alignment with clients creates the perfect recipe for long-term compounding. (And I get to drive my kids to school.)

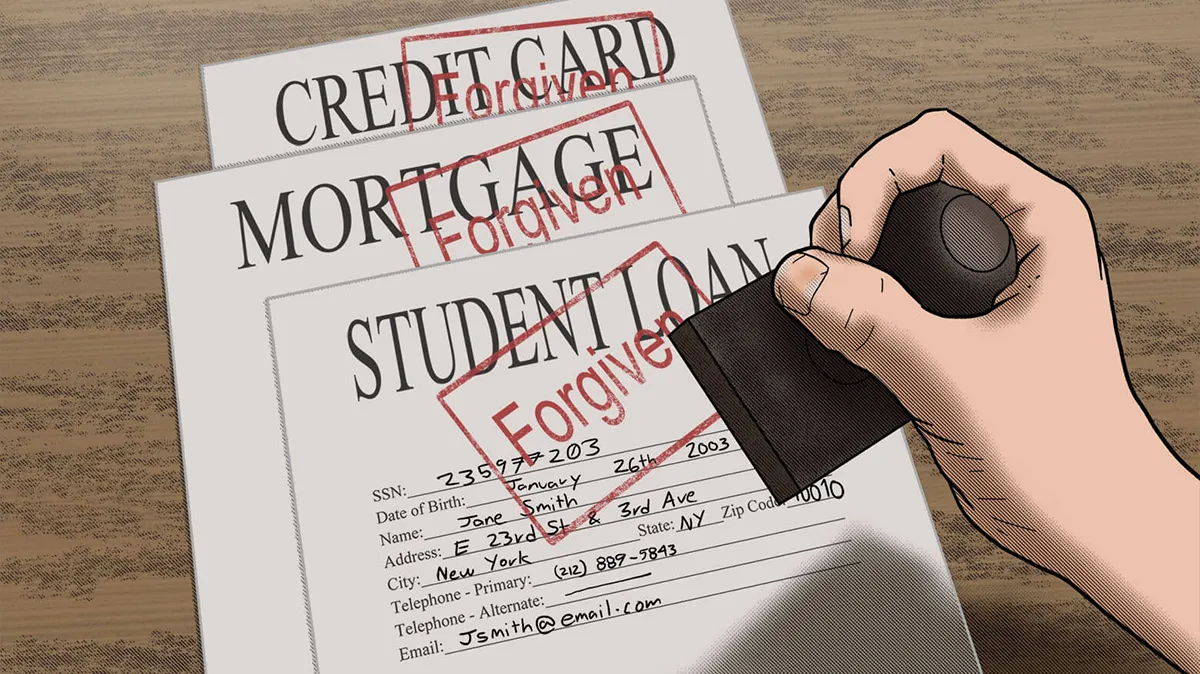

A Value Investor’s Analysis of Student Loan Forgiveness

Individual impact aside, Biden’s student loan forgiveness will also affect the US currency and economy. Here’s how we see it as value investors.

Why we bought more Uber shares as the stock fell

Despite being a very controversial choice, we believe Uber stock is still a great investment and have bought more on its way down. Here’s why.

Why Value Investing Requires Thoughtful Arrogance

You need arrogance as a value investor, but it can also be your downfall. So how do you master the psychological side of value investing?

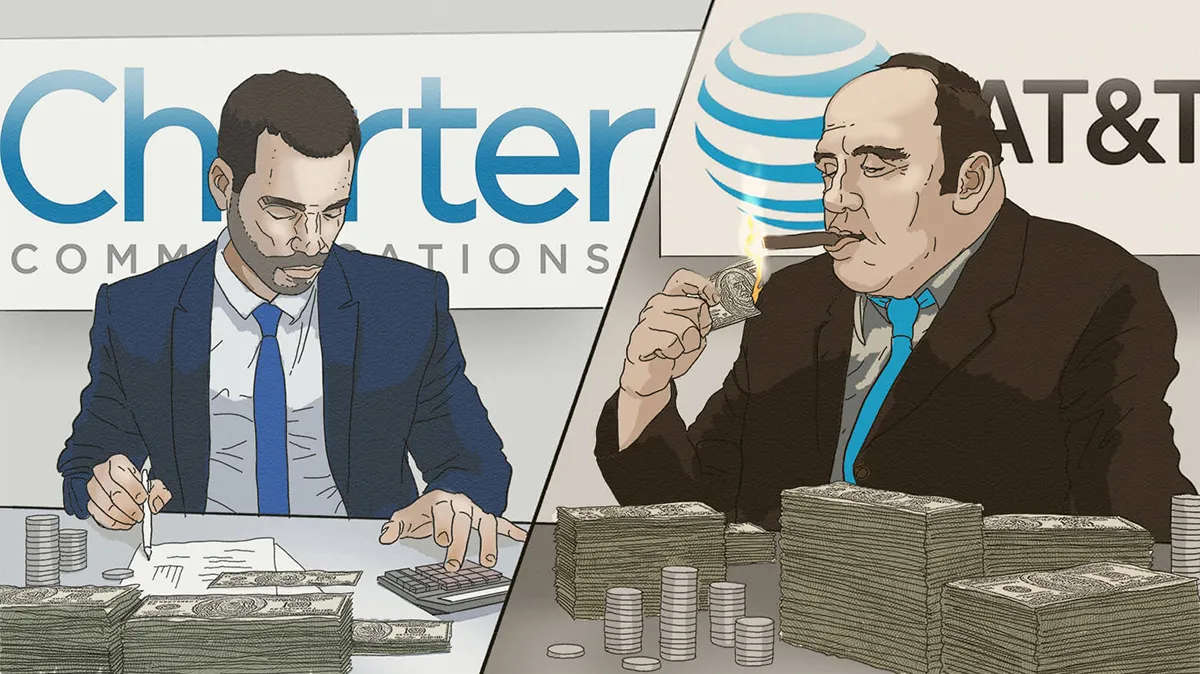

Charter Communications (CHTR) Stock: Heads we win, tails we don’t lose

Charter Communications (CHTR) is a significantly undervalued stock today. But are competition, 5G, and satellite internet significant threats to its business? How does its management compare to AT&T and Verizon? Read our analysis below.

Putin: The Mask is Off. Europe is Next.

When Putin started the war, he tried to shift the blame to NATO, calling it the instigator. He argued that Russia had no choice but to defensively launch the war to prevent NATO from surrounding Russia from all sides. A few days ago, Putin finally lifted his veil of pretense: this is a war of conquest.

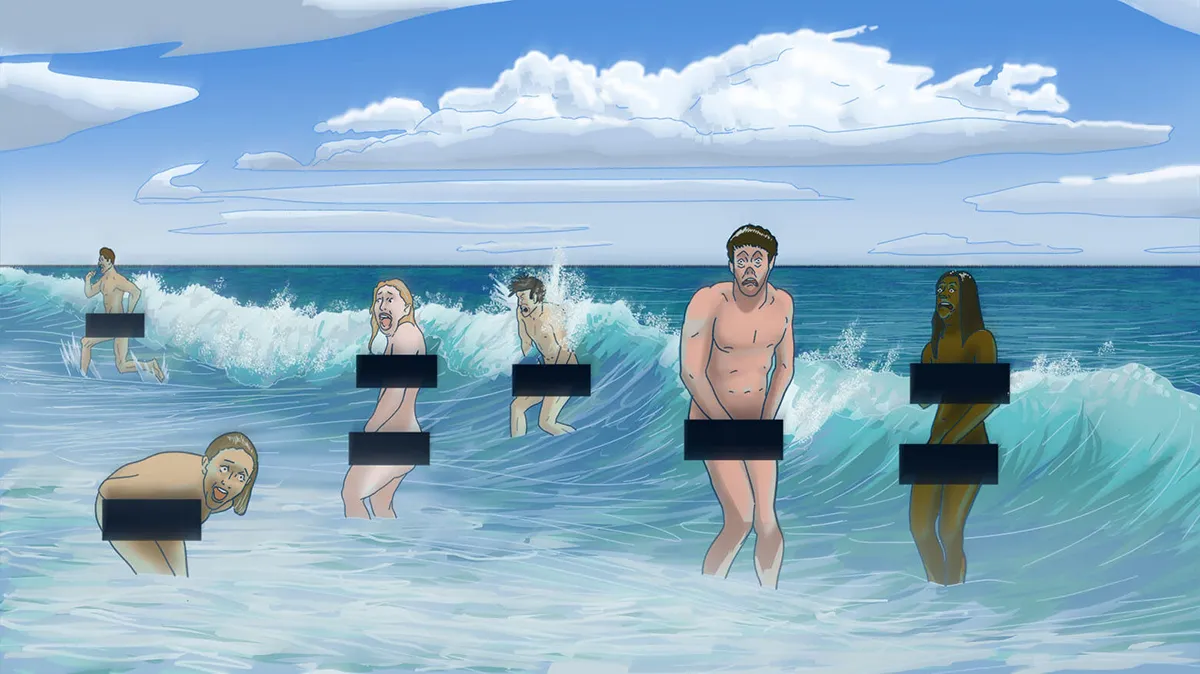

ARKK Stocks Sunk

The better ARK performed, the more money flowed into its main ETF, ARKK. It used this money to buy more sci-fi ARKK stocks, pushing up the prices of its holdings. This created a vicious cycle that has now reversed.

Why Is Inflation So High Right Now? 6 Reasons + What Happens Next

The war in Ukraine will likely pour more gasoline on the already raging inflationary fire, threatening to send the global economy into stagflation. Stagflation is a slowdown of economic activity caused by inflation.

A Value Investor Gathering in Omaha

I am hosting an intimate gathering for friends, readers, and fellow value investors from 8–10:30 AM on Friday, April 29, 2022, at Lula B’s in Omaha. Stop by and enjoy some delicious breakfast. If you show up early enough, you might even get a free signed copy of my new book, Soul in the Game: The Art of a Meaningful Life.

Mental Models for Investing – an Interview with The Value Perspective

I sat down with the Value Perspective podcast to discuss my value investing approach. Much of the conversation ended up focusing on mental models and frameworks that I’ve found useful in analyzing businesses - and the market as a whole - as a value investor. You can read the transcript or listen to the original podcast interview below.

War in Ukraine: Part 4 – Are There Neo-Nazis in Ukraine?

In his speech declaring war on Ukraine, the dictator of Russia, Vladimir Putin, said the goal of his “special operation” was the de-Nazification of Ukraine and ridding it of drug addicts. He’d remove the democratically elected government and install a Russia-friendly puppet government instead, thus expanding the power and influence of the Russian empire. But are there neo-Nazis in Ukraine?

War in Ukraine: Part 3 – The Future of Russia

Sanctions have a checkered history. They didn’t get rid of Castro in Cuba or the Kims in North Korea. It took more than a decade for sanctions against South Africa in the 1980s to bear fruit. But the world has never seen sanctions like this. Ironically, these sanctions may give Putin even more power.

War in Ukraine: Part 2 – The New World

Just as 9/11 dramatically changed the flow of history, resulting in two wars and hundreds of thousands of deaths and millions of lives ruined, so too will Putin’s invasion of Ukraine. Right now, we are seeing only the first effects and getting glimpses of second-order effects. The broad third-order effects will not be visible for a long time, though they’ll be obvious in hindsight.