A basic property of religion is that the believer takes a leap of faith: to believe without expecting proof. Often you find this characteristic of religion in other, more unexpected places–like the stock market.

It takes a while for a company to develop a “religious” following: Only a few high-quality, well-respected companies with long track records ever become worshipped by millions of investors. The stock has to make a lot of shareholders happy for a long period of time to form this psychological link.

The stories (which are often true) of relatives or friends buying a few hundred shares of the company and becoming millionaires have to percolate a while for a stock to become a religion. Little by little, the past success of the company turns into an absolute and eternal truth. Investor belief becomes set: The past success paints a clear picture of the future.

Gradually, investors turn from cautious shareholders into loud cheerleaders. Management is praised as visionary. The stock becomes a one-decision stock: buy. This euphoria is not created overnight. It takes a long time to build it, and a lot of healthy pessimists have to become converted into believers before a stock becomes a “religion.”

Religion stocks are held on faith. The traditional analysis is rarely applied, as it is perceived that these companies operate in a different gravitational field and that the laws that drive the valuations of the rest of the market are suspended when it comes to them. Take General Electric. Until recently, it was perceived as an infallible, can-do-nothing-wrong corporate icon. Its shares were passed from generation to generation with a whisper: “Never sell GE.”

However, once the religious, unconditional, in-GE-we-trust veil was lifted, many found it to be just another complex, un-analyzable financial conglomerate that is suffering from addiction to the commercial paper market. There is nothing new I can really say about GE except that it represents what is wrong with religion stocks–it is bought (and actually in most cases held) on faith. Few attempted to value it beyond looking at reported ruler-like earnings that were played like a fiddle by management by manipulating pension plan assumptions and shifts in reserves in opaque GE finance.

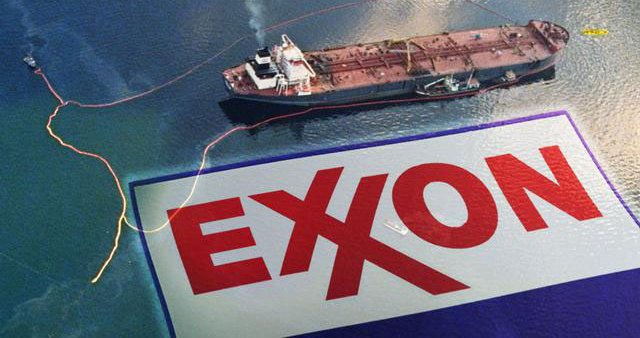

Today’s discussion is not about GE but about another religion stock that is about to get its religious veil stripped. I have to warn you, it is another infallible corporate icon that can do nothing wrong: Exxon Mobil–the biggest (nongovernment-owned) oil company in the world, the $400 billion market cap gorilla that brought wealth to generations of people.

What is wrong with Exxon? On the surface, very little. It has $25 billion of net cash (cash less debt); it grew revenues and earnings on per share basis at 16.5% and 25%, respectively, over the last five years; it pays a decent dividend of 2.1%; and the stock is a true bellwether, as it is down only 15% year-to-date, when the market is down at least double that. Here is the best part: It trades at only nine times estimated 2008 earnings of $8.75 per share.

Wait a second, this does sound like a perfect stock! This type of superficial, on the surface analysis is only granted to religious stocks. Their long-term track and an aura of reverence establish the leap of faith that eases us into drawing straight lines from the past into the future, and this is very dangerous.

Arguably, a similar “religious” attitude created by a consistent 12% a year, ruler-like performance and a blue chip pedigree ( as a founder of Nasdaq) allowed Bernard Madoff to lower the guard of even very sophisticated investors and deprive them of billions.

If you were to take off the religious veil from Exxon and look under the surface, you’ll find quite a different story. The incredible double-digit revenue and earnings growth came completely from the big rise in oil and natural gas prices. XOM spent close to $90 billion finding new oil and natural gas, but oil reserves have not increased at all. Gas reserves are up 25% since 2003, but gas production increased very little.

I invite you to spend some time with XOM’s annual report. You’ll find that volumes of production and reserves in all its segments have not moved much since 2003. In many cases, they declined. So the magic behind all that growth over the last five years had little to do with XOM’s operating performance but was totally driven by commodity prices and share buybacks.

You might say that XOM is at only nine times earnings, and there’s not much growth built into the stock. Keep in mind, however, that XOM only trades at that valuation if it can earn what it earned in 2008 when oil prices were between $85 and $150. Unfortunately for XOM, fortunately for rest of us, oil prices are making five-year lows, revisiting the mid-30s.

My motto in life that I borrowed from Keynes is “I’d rather be vaguely right than precisely wrong.” Let’s figure what XOM’s vaguely right valuation is.

Exxon’s earnings overstate its true earnings power. To estimate XOM’s earning power at today’s prices, let’s look what it made when oil prices were in the 30s and 40s. In 2003 and 2004, when oil prices averaged $28 and $38, XOM made about $3 and $4 a share, respectively. Since XOM’s reserves are not growing, it is reasonable to expect no growth of production in the future. Don’t deceive yourself: XOM is just an operationally leveraged proxy for oil (and natural gas).

If oil stays where it is today XOM will not earn $8.75, as the Street expects it to earn in 2008. Is earnings will be around $3 or $4. It is trading at 20 to 25 times these earnings. This is a very high valuation for today’s environment, where companies with similarly strong balance sheets, with pricing power (XOM is a price taker), and whose cash flows are increasingly independent of what commodities are doing (non-cyclical) pay higher dividend yields and trade 10 or 12 times true earnings. Yes, there is a 50% downside in XOM’s stock.

My crystal ball on oil prices is as good as the next guy’s, but it is reasonable to expect that demand for oil will only be declining while the global economy is in a recession that only started in earnest a couple of months ago. Also, despite OPEC’s “production cuts,” the economies of its members are one-trick-ponies–they export petro chemicals and import everything else. As their oil revenues collapse, despite their threats, they cannot afford to produce less oil, and they have to keep building those golden palaces in the desert. So demand is declining, and supply may actually rise.

Let’s call today’s $30-$40 oil the seminormal case, though it could get worse. But what if oil prices go to $150? It is an unlikely scenario, at least while the global economy is in a recession, but in this case XOM has an upside of about 20%, as this summer it traded in the 90s when oil went to $147.

Exxon may be a great company. It made a lot of investors happy, but its success is in the past–it is simply too big to grow and it can barely find enough oil to replenish its reserves. Probably not in the very distant future its reserves will start declining–over 90% of oil reserves are owned by foreign governments, and they are not really looking forward to parting with them. Investors who own Exxon are gambling on oil and natural gas prices, and the odds are stacked against them: tails (high probability) you are down 50%, heads (low probability) you are up 20%. Even Vegas slot machines have better odds.

Emotions have no place in investing. Faith, love, hate and disgust should be left for other aspects of our life. More often than not, emotions guide us to do the opposite of what we need to do to be successful. Investors need to be agnostic toward “religion stocks.” The comfort and false sense of certainty that those stocks bring to the portfolio come at a huge cost: prolonged underperformance.

P.S. There are couple additional but important caveats to XOM’s valuation: XOM bought almost a quarter of its shares since 2004, thus if XOM were to make the same income today as it did 2004 for its EPS would higher (net income divided by lower share count gives you higher EPS). Second, costs have increased substantially: cost of finding new oil doubled from 2003 and getting oil out of the ground up 40% from 2003. These two factors cancel out each other.

Another point on valuation: XOM’s capital expenditures exceeds it depreciation expense thus on free cash flows – a true determinate of company’s worth, is lower than net income by about 30%. For the simplicity of the analysis, I used P/E with unadjusted E, but you really need to adjust your E down to reflect lower free cash flows.

0 comments